claim workers comp taxes

For example many retirement benefits you. Moreover an experienced workers compensation attorney may be able to structure your workers comp settlement in a way that minimizes the offset and reduces your taxable income.

Is Workers Comp Taxable What To Know For 2022

About the Author.

. It makes sense that workers compensation benefits are not taxed. Report this on line 22900. Do you claim workers comp on taxes the answer is no.

Workers compensation is generally not taxable and is not earned income so it would not qualify you for EITC. Most workers compensation benefits are not taxable at the state or federal levels. For example if you took money out of a 401 k to subsidize your income while you were receiving workers compensation that distribution may be subject to.

Yes you can but you dont always have to. Income from the WCB will be reported in Box 10 of the T5007 slip. While workers compensation.

You can find the amount of your workers compensation benefit that was paid as a portion of your income on your T4 slip. Do you claim workers comp on taxes the answer is no. Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a workers compensation act or a.

While workers compensation benefits are tax-exempt they can have an effect on your taxes especially if you receive social security disability insurance supplemental security income or. Some of it Start researching the tax rules on it. Yes all of it 2.

However a portion of your workers comp benefits may be taxed if you also receive Social Security Disability Insurance SSDI or Supplemental Security Income SSI. If your tax adviser wants to know the amount you can explain that the benefits are not taxed. He received the Order of Service award from the North Carolina Advocates for Justice in 2017 2018 and 2019.

Matt Harbin is a workers compensation attorney in North Carolina at the Law Offices of James Scott Farrin. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. Any workers compensation benefit that you can receive is exempt from taxes.

According to the IRS you do not have to pay income taxes on benefits paid under workers compensation. First even though you dont always have to pay taxes on most workmans comp sometimes you may have to report it to the IRS. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

Workers compensation is in the same category of non-taxable income as the following. No none of it 3. Workers comp laws vary from state to state so it would pay to get legal advice in this situation.

Surprisingly some tax preparers will ask Of course consult your accountant with tax questions to avoid additional liability. Although workers compensation is not taxable you are still required to file a return if the income you earned in addition to your workers compensation meets the IRS filing requirements. Answer 1 of 2.

A workers compensation attorney might suggest you spread out lump-sum payments or shift to Social Security retirement benefits to minimize the offset and avoid tax issues. However retirement plan benefits are taxable if either of these apply. DISCLAIMER - More Information.

The Employers Insurers TPAs section of the Workers Compensation portion of this web site is targeted specifically to employers insurers and third party administrators and is intended to be a resource throughout the workers compensation claim processIt is NOT intended to be a substitute for legal representation. IRS Publication 525 pg. To discuss your legal options with a free consultation contact Rubens Kress and Mulholland online at 312 728-3014 or toll-free at 866 938-4713.

Workers compensation for an occupational sickness or injury if paid under a workers compensation act or similar law. Not an easy read but it is fun not. According to the IRS the answer is no.

To get more information about Illinois. If the disability is expected to continue beyond the period claimed on the initial CA-7 the employee should complete. However the government does not look at workers comp in the same way that it looks at actual wages earned.

The answer could be depending on the details of your individual situation. While this amount is not subject to tax you are still required to report it. Thus while a portion of your workers comp may considered taxable income in practice the taxes paid on workers comp are usually small or non-existent.

From IRSs Publication 525. South Australian workers will still be able to claim compensation for multiple injuries caused in the same incident following the state. Ferrell Newman Reappointed as Commissioner of the Virginia Workers Compensation Commission 01062022 - Commission issues Order Regarding Mask.

Since they are already based on two-thirds of your wages it would be counterproductive to take out taxes in addition to that when the purpose of benefits is to cover necessities such as medical care and living expenses. Claim workers comp taxes Friday March 11 2022 Edit Check the workers compensation coverage for your employer File a claim against the Workers Compensation. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel.

As long as you are receiving your benefits from workers compensation you will not have to pay taxes. Tax Liability from Combined Disability Income. In fact IRS publication 907 states in pertinent part.

Should I claim workers comp benefits on my taxes. Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if they are paid under a workers compensation act or a statute in the nature of a workers compensation act. Recent Internal Revenue Service IRS rules state.

May 31 2019 443 PM. The quick answer is that generally workers compensation benefits are not taxable. Typically taxable workmans compensation is.

No other documents are. The following payments are not taxable. However this is not true for the benefits you can receive from other programs while receiving workers compensation benefits.

But as we noted most workers compensation claims are straightforward affairs. No workers compensation benefits are not taxable at either the federal or the state level theyre generally payable at 23 of what your wages were before the injury but because theyre not taxable it usually works out to approximately the same kind of wage as you would net out on your taxable wages. Pennsylvania Lawyers For Workers Compensation Claims.

Matt also was honored on the Best Lawyers a list for Workers Compensation Law Claimants by Best. Do I have to Pay Taxes on Workers Comp Benefits. Report your employment income Box 14 of your T4 slips on line 10100 of your return as normal.

Answer 1 of 2. However retirement plan benefits are taxable if either of these apply. We concentrate on workers compensation claims and we charge no fee unless you collect.

Workers comp rules are very complicated. And then you can claim any of the tax credits available for those with disabilities stemming from work-related injuries.

California Workers Comp How To Take Charge When You Re Injured On The Job Brought To You By Avarsha Com Worker Take Charge Personal Injury Claims

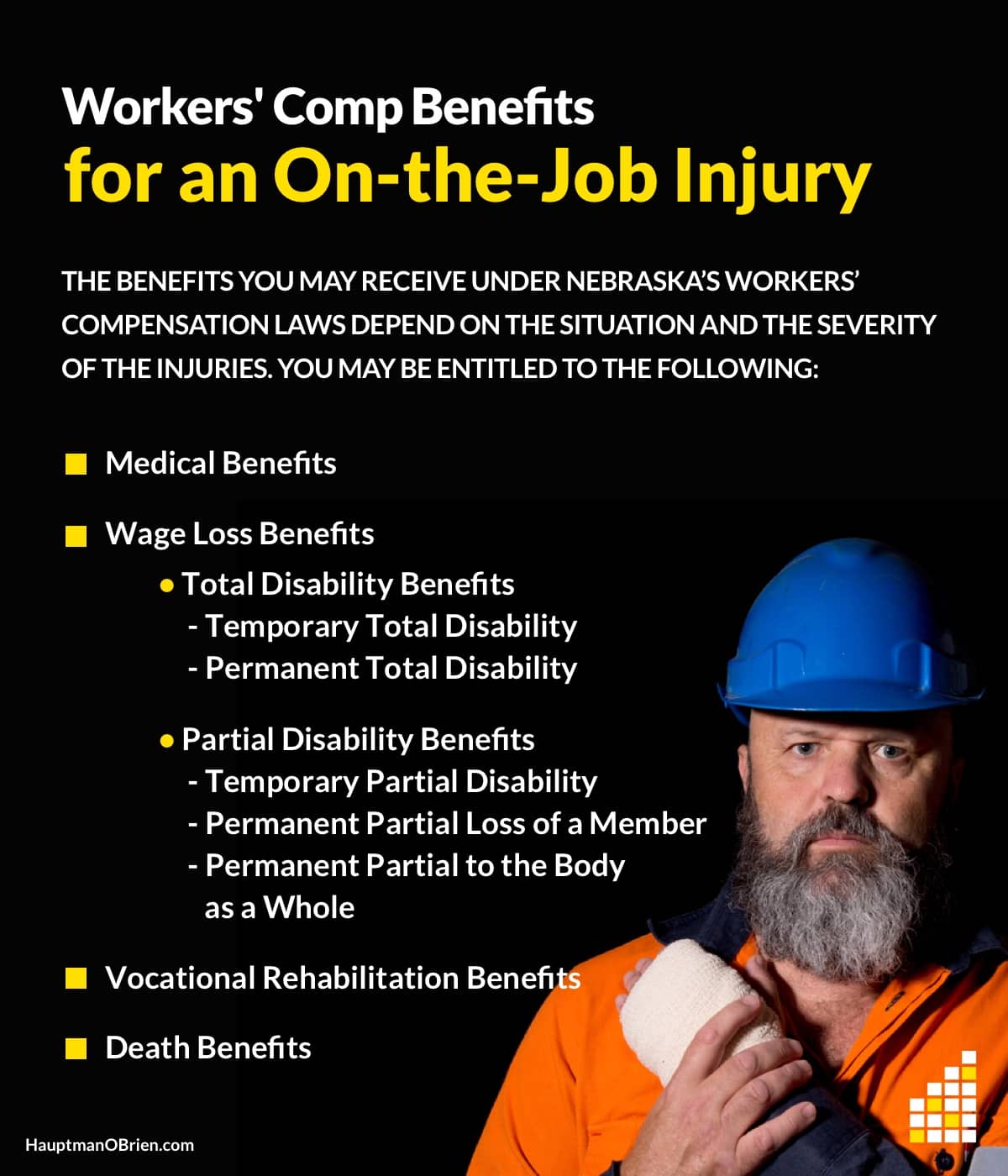

Nebraska S Workers Compensation Laws Explained

Ncci State Map State Map Small Business Insurance Map

Do I Have To Pay Taxes On My Workers Comp Benefits

Is Workers Comp Taxable Workers Comp Taxes

How To Cash A Workers Comp Check Worker Retirement Benefits Social Security Administration

Is Workers Comp Taxable In Nj Craig Altman

What Wages Are Subject To Workers Comp Hourly Inc

Ohio Workers Compensation Benefits And Income Tax Monast Law Office

Many People Live Paycheck To Paycheck And Missing Any Time Because Of A Workplace Accident Can Result In A Financial Dis Paying Taxes Worker Workplace Accident

Is Workers Comp Taxable Gordon Gordon Law Firm

Peos Have Many Benefits But One Of The Biggest Lies In Their Workers Compensation Insurance Coverage Workers Compensation Insurance Company Benefits Payroll

Is Workers Compensation Taxable In North Carolina Riddle Brantley

Most Affordable Merchant Services Workers Compensation Insurance Merchant Services Workers Comp Insurance

Workers Compensation And Taxes James Scott Farrin

Workers Comp Guide For The Self Employed Smallbizdaily Workers Compensation Insurance Social Media Marketing Training Worker

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys